Legacy Giving

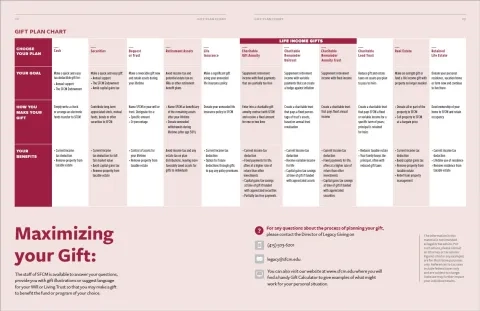

Legacy gifts are crucial to the ongoing success of SFCM, and these gifts are especially important for the dual benefits they provide you, your family and friends as well as the lives of SFCM students.

There are some simple no-cost actions you can take today which make a lasting impact on SFCM in the future. Some of the more common ways are listed below, however, depending on the complexity of your estate, can take careful planning and is best discussed with a qualified estate planning professional. Please review this useful guide to assembling your estate planning team.

Here are some of the ways you can take action today.

Gifts from a Bequest

Leave a percentage or set amount as part of your estate.

- This can be written into a Will or Trust document or you can add to an existing plan with a Codicil.

- Make a gift of cash or an appreciated asset and receive an estate tax deduction for the value of your gift.

- For more information, please read this Bequest Language Document

Types of Bequest

A specific bequest involves making a gift of a specific dollar amount, an asset such as a property, or a specific item. For example, you may wish to leave $100,000 to SFCM to support our annual fund.

Another kind of bequest involves leaving a specific percentage of your overall estate to SFCM to support our annual fund or endowment.

A residual bequest is made from the balance of an estate after the will or trust has given away each of the specific bequests. A common residual bequest involves leaving a percentage of the residue of the estate to charity. For example, you may wish to leave 25% of the residue of your estate to SFCM to support our annual fund or endowment.

A contingent bequest is made to charity only if the purpose of the primary bequest cannot be met. For example, you could leave 50% of your estate, to a relative, but the bequest language could provide that if the relative is not alive at the time of your death, that percentage of your estate will go to SFCM.

Gifts of Stock or Securities

Donating appreciated securities, including stocks or bonds, is an easy and tax-effective way for you to make a gift.

- Avoid paying capital gains tax on the sale of appreciated stock

- Receive a charitable income tax deduction

- Further our mission today or in the future

There are special rules for valuing a gift of stock. The value of a charitable gift of stock is determined by taking the mean between the high and low stock price on the date of the gift. Mutual fund shares are valued using the closing price for the fund on the date of the gift.

Gifts from an IRA

Donating part or all of your unused retirement assets such as a gift from your IRA, 401(k), 403(b), pension or other tax-deferred plan is an excellent way to make a gift.

- Avoid potential estate tax on retirement assets

- Heirs avoid income tax on any retirement assets funded on a pre-tax basis

- Receive potential estate tax savings from an estate tax deduction

To leave your retirement assets to SFCM, you will need to complete a beneficiary designation form provided by your retirement plan custodian.

-

If you designate SFCM as a beneficiary, we will benefit from the full value of your gift because your IRA assets will not be taxed at your death.

-

Your estate will benefit from an estate tax charitable deduction for the gift.

Gifts of Insurance

A gift of your life insurance policy is an excellent way to make a gift to charity.

If you have a life insurance policy that has outlasted its original purpose, consider making a gift of your insurance policy. For example, you may have purchased a policy to provide for minor children and they are now financially independent adults.

Gifts from a Donor Advised Fund

A donor-advised fund (DAF) is a charitable giving vehicle administered by a sponsoring organization and created for the purpose of managing charitable donations on behalf of an organization, family, or individual.

It allows donors to make a charitable contribution, receive an immediate tax benefit, and then recommend grants from the fund over time.

If you have a donor-advised fund with a sponsoring organization, please consider making a distribution to the San Francisco Conservatory of Music or listing us as a final beneficiary. You may request an immediate distribution or make a grant recommendation utilizing the DAF Direct tool below.

DAF Direct enables you to recommend grants to the Foundation, directly from your DAF (as long as your DAF's sponsoring organization is participating). The following organizations are currently participating via the DAF Direct widget: Fidelity Charitable, Schwab Charitable, and BNY Mellon. Neither you nor the Foundation will incur any download or transaction fees.

Gifts of Real Estate

Donating appreciated real estate, such as an unmortgaged home, vacation property, undeveloped land, farmland, ranch or commercial property can make a great gift.

You may deed part or all of your real property to SFCM by executing or signing a deed transferring ownership. Your gift will generally be based on the property's fair market value, which must be established by an independent appraisal.

- Avoid paying capital gains tax on the sale of the real estate

- Receive a charitable income tax deduction based on the value of the gift

- Leave a lasting legacy to SFCM

If you would like to find out more about our funds and programs, please contact the Director of Legacy Giving at (415)503-6201 or email your inquiry to legacy@sfcm.edu.